Updated on 6/13/2020

During this unprecedented crisis of coronavirus outbreak, governments, international organizations and other authorities are intensifying their efforts to combat various criminal and fraudulent activity related to that. You may have already seen reports of fraudulent activity around the sale of face masks and hand sanitiser.

The COVID-19 pandemic has generated various government responses, ranging from social assistance and tax relief initiatives, to enforced confinement measures and travel restrictions. While unintended, these measures may provide new opportunities for criminals and terrorists to generate and launder illicit proceeds.

Criminals have been quick to seize opportunities during the COVID-19 pandemic to generate significant amounts of profit. Certain types of criminal activity intensified during the pandemic, while others almost ceased to occur. Even during times of crisis, criminal business continues.

Scammers are sophisticated, opportunistic and will try to get personal details or money from victims in many ways. They tend to target people who are more vulnerable or susceptible to being scammed, particularly in the current climate with many more people being at home.

– INTERPOL warns of financial fraud linked to COVID-19;

– EUROPOL issued multiple reports on the criminal situation in Europe during the Coronavirus pandemic;

– Statement by the FATF President: COVID-19 and measures to combat illicit financing; COVID-19-related Money Laundering and Terrorist Financing Risks and Policy Responses issued by FATF;

– OLAF launches enquiry into fake COVID-19 related products;

– UK FCA on how to avoid coronavirus scams;

– Austria FMA warns about a strong increase in fraudulent activities in the financial markets in conjunction with the Corona pandemic;

– USA Justice Department Files Its First Enforcement Action Against COVID-19 Fraud

– California Attorney General Issues Consumer Alert on Fraudulent Charities Amid the COVID-19 Public Health Emergency

INTERPOL is encouraging the public to exercise caution when buying medical supplies online during the current health crisis, with criminals capitalizing on the situation to run a range of financial scams.

With surgical masks and other medical supplies in high demand yet difficult to find in retail stores as a result of the COVID-19 pandemic, fake shops, websites, social media accounts and email addresses claiming to sell these items have sprung up online.

But instead of receiving the promised masks and supplies, unsuspecting victims have seen their money disappear into the hands of the criminals involved.

EUROPOL issued reports on “Pandemic profiteering – how criminals exploit the COVID-19 crisis” (03/2020) and report “Beyond the pandemic how COVID-19 will shape the serious and organised crime landscape in the EU” (04/30/2020);

The European Anti-Fraud Office (OLAF) has opened an enquiry concerning the imports of fake COVID-19 related products, which are ineffective or even detrimental to health. On 19 March 2020, OLAF opened a case in relation to the imports of fake products used in the fight against the COVID-19 infection, such as masks, medical devices, disinfectants, sanitisers and test kits. Since the very beginning of the pandemic, OLAF has been collecting intelligence and information on this illicit trafficking.

Federal Court in USA Issues Temporary Restraining Order Against Website Offering Fraudulent Coronavirus Vaccine. As detailed in the civil complaint and accompanying court papers filed on Saturday, March 21, 2020, the operators of the website “coronavirusmedicalkit.com” are engaging in a wire fraud scheme seeking to profit from the confusion and widespread fear surrounding COVID-19. Information published on the website claimed to offer consumers access to World Health Organization (WHO) vaccine kits in exchange for a shipping charge of $4.95, which consumers would pay by entering their credit card information on the website. In fact, there are currently no legitimate COVID-19 vaccines and the WHO is not distributing any such vaccine. In response to the department’s request, U.S. District Judge Robert Pitman issued a temporary restraining order requiring that the registrar of the fraudulent website immediately take action to block public access to it.

California Attorney General Xavier Becerra issued on March 26, 2020 consumer alert to warn Californians about fraudulent charities during the ongoing COVID-19 public health emergency. The virus has thus far infected 2,535 Californians and has resulted in a state-wide shelter in place order, issued by California Governor Gavin Newsom. Attorney General Becerra reminds all Californians to do their research before submitting donations to any charity, especially during a time of crisis

FATF encourages governments to work with financial institutions and other businesses to use the flexibility built into the FATF’s risk-based approach to address the challenges posed by COVID-19 whilst remaining alert to new and emerging illicit finance risks. The FATF encourages the fullest use of responsible digital customer onboarding and delivery of digital financial services in light of social distancing measures. At a time when critical relief is needed in-country and beyond, effective implementation of the FATF Standards fosters greater transparency in financial transactions, which gives donors greater confidence that their support is reaching their intended beneficiaries.

Criminals are taking advantage of the COVID-19 pandemic to carry out financial fraud and exploitation scams, including advertising and trafficking in counterfeit medicines, offering fraudulent investment opportunities, and engaging in phishing schemes that prey on virus-related fears. Malicious or fraudulent cybercrimes, fundraising for fake charities, and various medical scams targeting innocent victims are likely to increase, with criminals attempting to profit from the pandemic by exploiting people in urgent need of care and the goodwill of the general public and spreading misinformation about COVID-19. National authorities and international bodies are alerting citizens and businesses of these scams, which include impostor, investment and product scams, as well as insider trading in relation to COVID-19. Like criminals, terrorists may also exploit these opportunities to raise funds.

Using information provided to the members of the FATF Global Network, it was issued a paper which identifies challenges, good practices and policy responses to new money laundering and terrorist financing threats and vulnerabilities arising from the COVID-19 crisis.

Austria FMA’s Executive Directors, Helmut Ettl and Eduard Müller warn the public: “Remain critical, even in a time of crisis. Stick with usual control mechanisms and precautionary measures even in these particularly challenging times. In such times, the old adage applies more than ever that if something sounds too good to be true, then it generally isn’t true.”

Key factors with impact on crime during and after pandemic

ONLINE ACTIVITIES – More people are spending more time online throughout the day for

work and leisure during the pandemic, which has greatly increased the attack vectors and surface to launch various types of cyber-attacks, fraud schemes and other activities targeting regular users. A lot of these goods are offered on online trade platforms, which have made it easier and cheaper for counterfeiters and other criminals to access a broad

customer base. Creating virtual and obscuring real identities is easier online than in offline interactions, which greatly aids criminals using aliases and creating front companies online. Certain population segments (e.g., the elderly, low-income groups, and remote or indigenous communities) may be less familiar with using online banking platforms, and therefore more susceptible to fraud.

DEMAND FOR AND SCARCITY OF CERTAIN GOODS – Demand for and the scarcity of certain goods, especially healthcare products and equipment, is driving a significant portion of criminals’ activities in counterfeit and substandard goods, organised property

crime and fraud. A potential economic recession may also stimulate social tolerance for these types of goods and their distribution.

PAYMENT METHODS – The pandemic is likely to have an impact on payment preferences

beyond the duration of the pandemic. With a shift of economic activity – including shopping for everyday goods – to online platforms, cashless transactions are increasing in number, volume and frequency. Even offline transactions are shifting to cashless payment options, as cash is seen as a potential transfer medium for COVID-19. Cashless payment options are likely to continue to gain in popularity and plurality covering credit card payments, payment platforms, virtual currencies and other mediums.

CRIMINAL USE OF LEGAL BUSINESS STRUCTURES AND MONEY LAUNDERING – The ease of establishing legal business structures has been of great benefit to the economy. However, this has also been effectively exploited by organised crime. During the COVID-19 pandemic, criminals have quickly exploited established legal business structures to orchestrate supply and fraud schemes, the distribution of counterfeit goods and money laundering.

ECONOMIC DOWNTURN – A potential economic downturn will fundamentally shape the serious and organised crime landscape. Economic disparity across Europe is making organised crime more socially acceptable as OCGs will increasingly infiltrate economically weakened communities to portray themselves as providers of work and services. Rising unemployment, reductions in legitimate investment and further constraints on the resources of public authorities may combine to present greater opportunities for criminal groups, as individuals and organisations in the private and public sectors are rendered more vulnerable to compromise. Increased social tolerance for counterfeit goods and labour exploitation has the potential to result in unfair competition, higher levels of organised crime infiltration and, ultimately, illicit activity accounting for a larger share of GDP. At the same time, trends for domestic human trafficking and organised property crime within the EU may intensify as a result of economic disparity between Member States.

MISDIRECTION OF GOVERNMENT FUNDS

– Exploiting stimulus measures: FATF and FSRB members report that a small proportion of economic support directed to businesses and individuals may present potential fraud risks, and consequent ML. In particular, criminals can falsely claim to provide access to stimulus funds to obtain personal financial information. FATF members report that criminals may use legal persons to make fraudulent claims on government stimulus funds by posing as legitimate businesses seeking assistance. Some FATF members reported taking steps to reduce risks, such as disbursing aid to people and businesses via existing government accounts for receiving social benefits.

Scams and other crimes trends linked to the virus include:

– Cybercrime – criminals have used the COVID-19 crisis to carry out social engineering attacks themed around the pandemic to distribute various malware packages. Criminals swiftly took advantage of the virus proliferation and are abusing the demand people have for information and supplies. Information received from law enforcement partners strongly indicates increased online activity by those seeking child abuse material. This is

consistent with postings in dedicated forums and boards by offenders welcoming opportunities to engage with children whom they expect to be more vulnerable due to isolation, less supervision and greater online exposure. The pandemic has an impact on Darkweb operations. Certain illicit goods will become more expensive, as source materials become unavailable. Vendors on the Darkweb offer special corona goods (scam material) at discounts. Criminals are exploiting concerns about COVID-19 to insert malware on personal computers or mobile devices. Amid a sharp rise in global remote working, cybercriminals are also exploiting weaknesses in businesses’ network security to gain access to customer contact and transaction information. This information is then used in targeted phishing emails whereby the criminals pose as the compromised business and request payment for legitimate goods and/or services but instead direct this payment into their illicit accounts.

– Telephone fraud / Phishing / Impersonation of officials – In such cases, criminals contact individuals (in person, email or telephone) and impersonate government officials with the intent of obtaining personal banking information or physical cash. In some cases, criminals impersonate hospital officials who claim a relative is sick and require payment for treatment, or government officials requesting personal banking information for tax relief purposes. Cases involving government impersonation are likely to increase as governments around the world disburse grants and tax relief payments to their citizens, with criminals attempting to profit from these payments. Also, instances found when emails are claiming to be from national or global health authorities, with the aim of tricking victims to provide personal credentials or payment details, or to open an attachment containing malware.

– Counterfeit goods – Counterfeiters have already been among the biggest profiteers of the COVID-19 pandemic. The sale of counterfeit healthcare and sanitary products as well as personal protective equipment and counterfeit pharmaceutical products has increased manifold since the outbreak of the crisis. There is a risk that counterfeiters will use shortages in the supply of some goods to increasingly provide counterfeit alternatives both on- and offline. Efforts to develop a vaccine against COVID-19 are ongoing around the world. Scammers are already offering versions of such a vaccine online.

– Fundraising for fake charities: FATF members highlight an increase in fundraising scams. In such cases, criminals posing as international organisations or charities circulate emails requesting donations for COVID-19-related fundraising campaigns (purportedly for research, victims and/or products). Recipients of these emails are then directed to provide credit card information or make payments through the suspect’s secure digital wallet.

– Child sexual exploitation online will remain a significant threat as long as children spend a majority of their time online during the lockdown, either during their spare time or while receiving education via longdistance learning arrangements. This threat requires continued close monitoring and prevention measures should be implemented to protect children online.

– Fraudulent investment scams: The economic crisis resulting from COVID-19 has led to an increase in investment scams, such as promotions falsely claiming that products or services of publicly traded companies can prevent, detect or cure COVID-19. Reporting by FATF members highlighted that microcap stocks, typically issued by the smallest companies, may be particularly vulnerable to fraudulent investment schemes as they are low-priced stocks with often limited publicly-available information. This facilitates the spread of false information about the company.

– Migrant Smuggling: While the economic impact of the COVID-19 crisis in Europe is not yet clear, it is expected to be significant and the impact on economies in the developing world is likely to be even more profound. Prolonged economic instability and the sustained lack of opportunities in some African economies such as Libya may trigger another wave of irregular migration towards the EU in the mid-term. This development needs to be carefully monitored.

– Trafficking in Human Beings: If the pandemic is followed by a recession, there may be an increased demand for labour and sexual exploitation and a potential increase in intra-EU trafficking of victims. Besides traditional fields of exploitation (prostitution, begging and theft, textile and agricultural sectors), sectors such as construction, tourism, catering, nursing and domestic services are increasingly affected by human trafficking. In addition to the prolonged harm suffered by victims of trafficking, the closure of businesses with lower profit margins due to an economic crisis will leave the market open to those with illegal or cheap labour at their disposal.

The most threatening and most profitable Organised Crimes Groups (OCG) remain highly flexible and will take advantage of opportunities to launder profits wherever possible. This may also include EU-based OCGs shifting their money-laundering operations to non-EU countries with weaker AML frameworks and lower resistance to attempts to introduce large amounts of capital from dubious sources during times of precarious economic stability, where they have not already done so.

What perpetrators tactics to look out for:

– Exploiting short-term financial concerns, scammers may ask you to hand over an upfront fee when applying for a loan or credit that you never get. This is known as loan fee fraud or advance fee fraud.

– ‘Good cause’ scams. This is where investment is sought for good causes such as the production of sanitiser, manufacture of personal protection equipment (PPE) or new drugs to treat coronavirus – with scammers using the promise of high returns to entice consumers.

– Using the uncertainty around stockmarkets, scammers may advise you to invest or transfer existing investments into high return (and high risk) investments.

– Clone firms – firms must be authorised to sell, promote, or advise on the sale of insurance products. Some scammers will claim to represent authorised firms to appear genuine. In particular, be aware of life insurance firms that may be cloned.

-Scammers may contact you claiming to be from a Claims Management Company (CMC), insurance company or your credit card provider. They may say they can help you recuperate losses by submitting a claim, for the cost of a holiday or event such as a wedding cancelled due to coronavirus. They will ask you to send them some money or your bank details.

– Cold calls, emails, texts or WhatsApp messages stating that your bank is in trouble due to the coronavirus crisis, and pushing you to transfer your money to a new bank with alternative banking details.

Examples:

-> The Czech Republic reported a cyberattack on Brno University Hospital which forced the hospital to shut down its entire IT network, postpone urgent surgical interventions and re-route new acute patients to a nearby hospital.

-> An investigation supported by Europol focuses on the transfer of €6.6 million by a company to a company in Singapore in order to purchase alcohol gels and FFP3/2 masks. The goods were never received.

-> Between 3-10 March 2020, over 34 000 counterfeit surgical masks were seized by law enforcement authorities worldwide as part of Operation PANGEA supported by Europol.

-> A 39-year old man has been arrested in Singapore for his suspected involvement in money laundering offences linked to a business email scam-related to COVID-19. This person was usurping the identity of a legitimate company and advertised the fast delivery of FFP2 surgical masks and hand sanitisers. A French pharmaceutical company had been defrauded of €6.64 million by this individual. Once the pharmaceutical company transferred the funds to a bank in Singapore, the items were never delivered and the supplier became uncontactable.

– A sophisticated fraud scheme using compromised emails, advance-payment fraud and money laundering has been uncovered by financial institutions and authorities across Germany, Ireland and the Netherlands, as part of a case coordinated by INTERPOL.

– Counterfeit masks have been offered online in different EU Member States at prices ranging between 5€ and 10€, approximately three times the normal price. Fake face masks for children are also being ruthlessly smuggled.

In many cases, the fraudsters impersonate legitimate companies, using similar names, websites and email addresses in their attempt to trick unsuspecting members of the public, even reaching out proactively via emails and messages on social media platforms.

If you are looking to buy medical supplies online, or receive emails or links offering medical support, looking for opportunities or just want to donate – be alert to the Signs of a potential scam to protect yourself and your money:

Independently verify the company/ charity/ individual offering the items before making any purchases and check if you’re dealing with a genuine firm;

Check the websites and email addresses offering information, products, or services related to COVID-19. Be aware of bogus websites – criminals will often use a web address which looks almost identical to the legitimate one, e.g. ‘abc.org’ instead of ‘abc.com’;

Check online reviews of any company offering COVID-19 products or supplies. Avoid companies whose customers have complained about not receiving items.;

Be wary if asked to make a payment to a bank account located in a different country than where the company is located;

If you believe you have been the victim of fraud, alert your bank immediately so the payment can be stopped.

Do not click on links or open attachments which you were not expecting to receive, or come from an unknown sender or unverified sources;

Be wary of unsolicited emails offering medical equipment or requesting your personal information for medical checks – legitimate health authorities do not normally contact the general public in this manner.

Reject offers that come out of the blue.

Beware of adverts on social media channels and paid for/sponsored adverts online.

Avoid being rushed or pressured into making a decision.

Do not give out personal details (bank details, address, existing insurance/ pensions/ investment details);

Ignore offers for a COVID-19 vaccine, cure, or treatment. Remember, if a vaccine becomes available, you won’t hear about it for the first time through an email, online ad, or unsolicited sales pitch;

Research any charities or crowdfunding sites soliciting donations in connection with COVID-19 before giving any donation. Remember, an organization may not be legitimate even if it uses words like “CDC” or “government” in its name or has reputable looking seals or logos on its materials.

Be wary of any business, charity, or individual requesting payments or donations in cash, by wire transfer, gift card, or through the mail. Don’t send money through any of these channels.

Be cautious of “investment opportunities” tied to COVID-19, especially those based on claims that a small company’s products or services can help stop the virus. If you decide to invest, carefully research the investment beforehand.

Donation Tips:

Check Registration Status: In many states the operating charities are required to register and required to file annual financial reports. Confirm that the charity is registered and up-to-date with their financial reporting.

Give to Organizations You Trust: Do your research before giving. Review the charity’s purpose and its financial records, and find out how it spends donations. How much is spent directly on the charitable cause? How much goes to overhead and employee compensation? Research charities in your community and support those charities that make a positive impact.

Don’t Be Pressured By Telemarketers And Ask Questions Before Donating: If you receive a call from a telemarketer, ask for the name of the fundraising organization, whether it is registered, the name of the charity benefitting from the solicitation, how much of your donation will go to charity and how much to the telemarketer, and the direct telephone number of the charity. If the telemarketer tells you the donation is for your local animal shelter, hospital, school, police department, firefighter or other public safety agency, check directly with the benefitting organization to confirm that they authorized the solicitation and will actually benefit from your donation. Don’t fall for pressure tactics or threats. Remember you have the right to reject the donation appeal and if you feel pressured or threatened, just hang up.

Be Cautious Of “Look-Alike” Websites: These fraudulent websites may have a slightly different web address (URL). Similar looking URLs are sometimes purchased to lure in would-be donors. These sites may ask for personal information or install harmful material onto your device.

Watch Out For Similar-Sounding Names And Other Deceptive Tactics: Some organizations use names that closely resemble those of well-established charitable organizations to mislead donors. Be skeptical if someone thanks you for a pledge you never made. Check your records.

Be Wary Of Social Network and Crowdfunding Websites: If you are planning to donate through a social network solicitation or through a crowdsourcing website, such as GoFundMe, find out what percentage is going to the charity, whether you will be charged a fee, or if a percentage of your donation will be paid to the platform website.

Protect Your Identity: Never give your Social Security number or other personal information in response to a charitable solicitation. Never give out credit card information to an organization unfamiliar to you. Some organizations sell or rent their donor lists to other organizations, including organizations that are not charities. Look at the charity’s privacy policy and learn who the charity might share your information with before you provide it.

More on:

https://www.interpol.int/News-and-Events/News/2020/INTERPOL-warns-of-financial-fraud-linked-to-COVID-19

https://www.europol.europa.eu/newsroom/news/how-criminals-profit-covid-19-pandemic

https://www.europol.europa.eu/newsroom/news/corona-crimes-suspect-behind-%E2%82%AC6-million-face-masks-and-hand-sanitisers-scam-arrested-thanks-to-international-police-cooperation

https://www.fatf-gafi.org/publications/fatfgeneral/documents/statement-covid-19.html

https://www.fatf-gafi.org/publications/fatfgeneral/documents/covid-19-ml-tf.html

https://eba.europa.eu/coronavirus

https://www.fca.org.uk/news/news-stories/avoid-coronavirus-scams

https://ec.europa.eu/anti-fraud/media-corner/news/20-03-2020/olaf-launches-enquiry-fake-covid-19-related-products_en

https://www.justice.gov/opa/pr/justice-department-files-its-first-enforcement-action-against-covid-19-fraud

https://oag.ca.gov/news/press-releases/attorney-general-xavier-becerra-issues-consumer-alert-fraudulent-charities-amid

https://www.europol.europa.eu/publications-documents/pandemic-profiteering-how-criminals-exploit-covid-19-crisis

https://www.interpol.int/en/News-and-Events/News/2020/Unmasked-International-COVID-19-fraud-exposed

https://www.europol.europa.eu/newsroom/news/corona-crimes-multi-million-face-mask-scam-foiled-police-across-europe

https://www.europol.europa.eu/publications-documents/beyond-pandemic-how-covid-19-will-shape-serious-and-organised-crime-landscape-in-eu

FMA warns about a strong increase in fraudulent activities in the financial markets in conjunction with the Corona pandemic

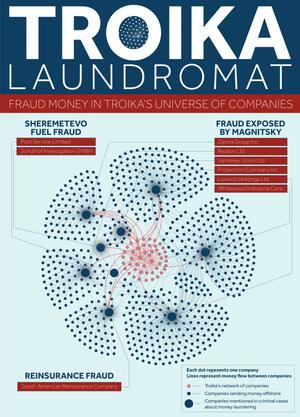

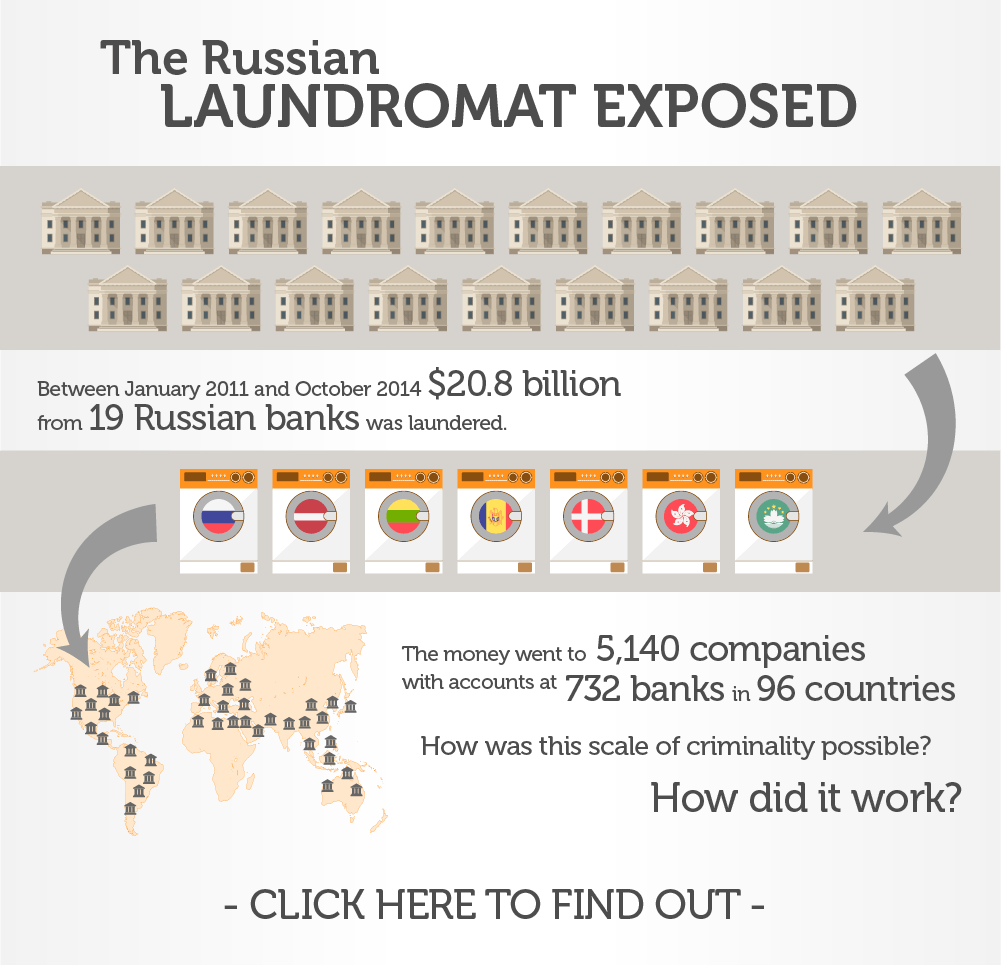

THE TROIKA LAUNDROMAT

THE TROIKA LAUNDROMAT